Moral Hazard Is a Concept Best Described as

It refers to change in economic behavior when individuals are protected or insured against certain risks and losses whose costs are borne by another party. If for example your car is fully insured against any and all damage and there is no deductible then.

Clients best interests this im-balance of knowledge can result in moral hazard.

. Conversely morale hazard describes an unconscious change in a persons behavior when he is insured. The English language contains many idioms. Any time two parties come into an agreement with one another moral hazard can occur.

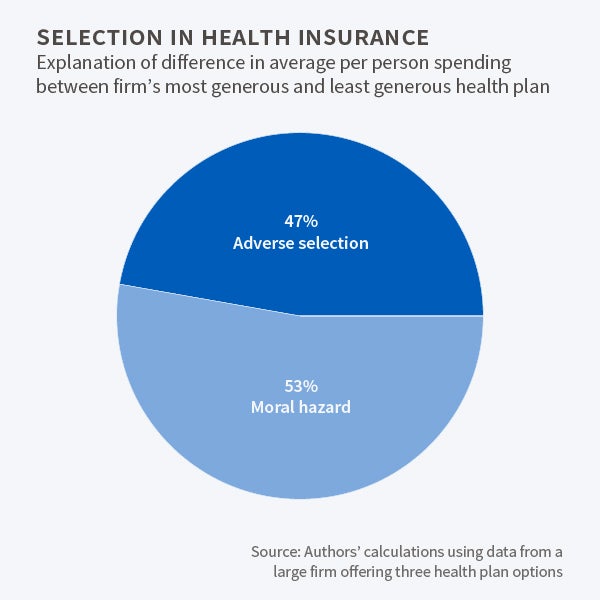

In the context of health insurance the term moral hazard is widely used and slightly abused to capture the notion that insurance coverage by lowering the marginal cost of care to the individual often referred to as the out-of-pocket price of care may increase healthcare use Pauly 1968. In the context of health insurance the term moral hazard is widely used and slightly abused to capture the notion that insurance coverage by lowering the marginal cost of care to the individual often referred to as the out- of-pocket price of care may increase healthcare use Pauly 1968. Moral hazard is a term describing how behavior changes when people are insured against losses.

Moral hazard is a situation in which one party gets involved in a risky event knowing that it is protected against the risk and the other party will incur the cost. What is the concept of moral hazard. Another aspect of moral haz-ard is that the more knowledge-able agent may take greater risk than the less knowledge-.

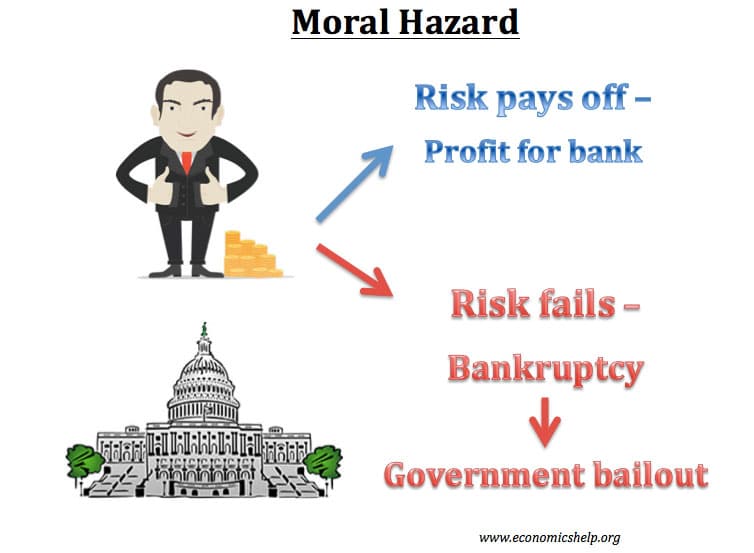

Moral hazard is a situation in which one party engages in risky behavior or fails to act in good faith because it knows the other party bears the economic consequences of their behavior. Moral hazard describes a conscious change in behavior to try to benefit from an event that occurs. Any time a party in an agreement does not have to suffer the potential consequences of a risk the likelihood of a moral hazard increases.

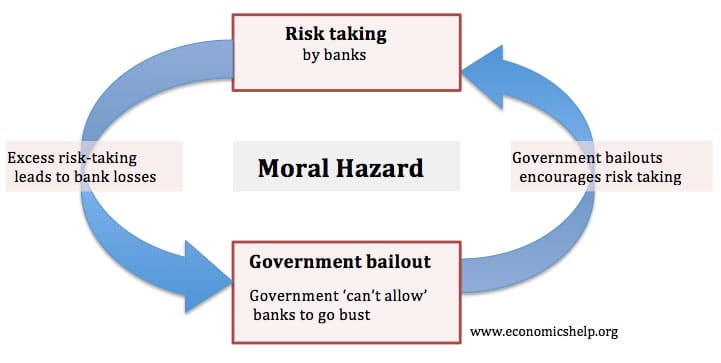

In economics a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. Click to see full answer. Moral hazard is the risk that a party has not entered into a contract in good faith or has provided misleading information about its assets liabilities or credit capacity.

This economic concept is. For example dental care insurance may lead individuals to be less cautious about their mouth hygiene which may be reflected in a higher probability of caries ex ante moral hazard. - moral hazard is the situation in which a person or an institution increases exposure.

Moral hazard is the tendency for people to behave in riskier ways knowing that someone else bears the cost of those risks. Despite its adoption by economists moral hazard was conceived as a moralistic term and often referred to the perfidy of the insured Dembe Boden 2000. It arises when both the parties have incomplete information about each other.

Moral hazard refers to an increase in the expected loss probability or amount of loss conditional on an event occurring due to individuals and firms behaving more carelessly as a result of purchasing insurance. It arises when both the parties have incomplete information about each other. An example of moral hazard is where the bro-kerage rm has more knowl-edge regarding the plan spon-sors duciary duties than the plan sponsor.

Clearly not all teething problems require. Purpose - Moral hazard is a concept that is central to risk and insurance management. Definition of Moral Hazard.

Moral hazard refers to the idea that certain types of insurance systems might cause individuals to act in a more dangerous way than normal causing a difference between the private marginal cost and the marginal social cost of the same action. - occurs under a type of information asymmetry where people taking risks or opting for more expensive procedures know more about their intentions than those that pay for the consequences. Moral hazard is a situation in which one party gets involved in a risky event knowing that it is protected against the risk and the other party will incur the cost.

It asserts that the presence of an insurance contract increases the probability of a claim and the size of a claim. Moral hazard is described as the increased chance of a loss because of an insureds dishonest tendencies People with higher loss exposure have the tendency to purchase insurance more often than those at average risk. The moral hazard problem refers to - The moral hazard problem refers to banks taking on more A.

Moral hazard is defined as a positive concept and 2 that the two words form an idiom that is. For example when a corporation is insured it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard is a situation where a person or business will have a tendency to take risks or alter their behavior because the negative costs or consequences that could result will not be felt by.

Gambling or insurance fraud. A group of words established by usage as having a meaning not deducible from those of the individual words Oxford English Dictionary OED 2008. It reflected a negative moral judgment of consumers who were deemed likely to engage in immoral behavior eg.

Conversely morale hazard describes an unconscious change in a persons behavior when he is. Moral hazard describes a conscious change in behavior to try to benefit from an event that occurs. Moral Hazard Moral hazard occurs when an individual facing risk changes ones behavior depending on whether or not one is insured.

Financial Markets Quiz Answers Quizerry

Moral Hazard An Overview Sciencedirect Topics

Asymmetric Information Adverse Selection Moral Hazard Economics Definitions Youtube

Moral Hazard An Overview Sciencedirect Topics

/types-of-insurance-policies-you-need-1289675-Final-6f1548b2756741f6944757e8990c7258.png)

Comments

Post a Comment